The Bankruptcy Capital: Memphis Myth or Tough Truth

Is Tunica a factor in the Bluff City's economic woes?

By Mitch Holmes, Insight News reporter

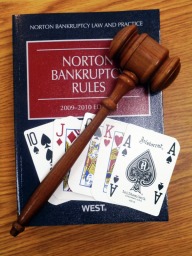

Photo by Mitch Holmes

Memphis – it’s a town that ranks near the top of too many undesirable lists: Most violent, fattest, most miserable. All of these rankings have been hotly debated. But one that is believed uncontested is the nickname the “Bankruptcy Capital.”

After all – the facts are clear. In 2008 Shelby County reported a bankruptcy rate four times the national average; that’s 1 out of every 70 people. In 2009, it topped the charts with the highest filing rate in the U.S., according to statistics gathered by the National Bankruptcy Research Center.

But not all bankruptcies are equal and some argue the facts are misleading.

One argument – that Memphis is a victim of its own filing practices, and that perhaps it’s simply the type of bankruptcy Bluff City lawyers file that may inflate the numbers.

Another possible factor – gambling. The cotton fields that once lined the western border of Memphis are now dotted with casinos; the sixth highest grossing gaming destination in the U.S.

Is there a link between gambling and bankruptcy, and if so, how great is the impact on Memphis?

We’ll look at bankruptcy in Memphis, the degree to which gambling impacts that rate and how the Mid-South compares to other gaming areas.

Memphis: The “honorable” bankruptcy capital?

When we think of bankruptcy, we normally think of an individual or corporation walking away from all debt. But that’s not the case in Memphis.

According to the chief judge for the West Tennessee division of the U.S. Bankruptcy court, the Bluff City’s sky high filing rate isn’t what it seems. Memphians seeking bankruptcy are actually encouraged to pay back their debts, not write them off.

“The bar (lawyers) and judges in West Tennessee encourage debtors to file for Chapter 11 or 13 bankruptcy and work out a reorganization plan to repay debts, as opposed to other courts which may encourage filing for Chapter 7 bankruptcy, which discharges you from all excusable debts,” said Kennedy. This more commonly known type of bankruptcy, which discharges or erases debt completely, is only filed once.

But Chapters 11 and 13 bankruptcies typically filed in Memphis encourages debtors to develop a payment plan carried out over a number of years. If for some reason, however, the debtor is unable to make payments, like job loss or medical bills, the bankruptcy case can be dismissed before the debtor receives a discharge. This means the debtor must re-file to begin paying off debts again. So, one debtor could account for numerous filings.

Judge Kennedy says it’s this difference that makes Shelby County’s rate appear so much higher than the rest of the country.

The role of gambling

Another factor widely believed to affect Memphis’ bankruptcy rate is gambling. Less than an hour’s drive from downtown Memphis sits one of the top casino gambling venues in the U.S. – Tunica, Mississippi.

The parking lots of Tunica casinos are regularly filled with Shelby County license plates and speculation has always run high that Memphis’ bankruptcy problem stems from its proximity to the casinos.

But there is little data to prove a definitive causal link between gambling and bankruptcy. Dr. Jim Whalen, co-founder of the Gambling Clinic at the University of Memphis, says there is no evidence supporting the belief that gambling leads to bankruptcy. This doesn’t mean, however, that the two are not related.

In fact, gambling is believed to account for the dismissal of many bankruptcy cases. An article in the American Bankruptcy Journal reports that debtors who have many different credit cards, accrued debts that outpaced income, and have shown few attempts to repay creditors will often be dismissed from filing. These are behaviors commonly associated with problem gamblers. It is these types of cases that are often dropped because the debtor is believed to have acted in “bad faith,” behavior that is determined unsuitable for bankruptcy.

The dismissal of bankruptcy cases is one of the reasons researchers have a difficult time determining any link to gambling. If a debtor is judged to have acted in “bad faith” because of a gambling addiction, his petition is dismissed and there is no record of the bankruptcy.

Sometimes gamblers receive a discharge without their gambling debts ever coming to light. According to Kennedy, debtors are only required to list their creditors and not their individual debts. “If a person takes out cash advances on their credit card and loses all of their money at the casino, when they file their petition they only have to list the credit card and not the casino where they lost the money,” said Kennedy.

The only way to determine if gambling is involved is to examine credit card history to determine if individual transactions took place at casinos. This is a step not regularly taken by bankruptcy courts.

Whalen argues that many of these gamblers actually intend to act in “good faith,” but the addiction often gets in the way. “They are good family members, neighbors, and co-workers and they really believe that they will pay back debt,” said Whelan, “Unfortunately, they typically believe that the debts will be cleared as soon as a big win occurs.” And too often – that big win never comes.

The Proximity Factor

If bankruptcy rates and reasons for filing are cloudy, some would argue that Memphis’ proximity to Tunica is explanation enough for the high bankruptcy rate.

So we decided to examine the bankruptcy rate of areas close to popular casino gambling sites to look for similarities. We evaluated six different gaming clusters: Tunica (Mississippi), Detroit, St. Louis, Atlantic City (New Jersey), Foxwoods (Connecticut), and Niagara Falls. Each of these areas has at least two casinos within the metropolitan area. The clusters include the county that is home to casino gambling and each adjacent county.

These clusters were then analyzed for bankruptcy rates and where these rates ranked within each state, according to 2008 data from the Administrative Office of the U.S. Courts.

What we found is that all of these clusters had an average filing rate of 4.43 per 1,000 households or approximately 1 in every 225 people had filed for bankruptcy. That’s compared to the U.S. average of 3.53 or 1 out of every 284 people.

The comparison shows that only Connecticut had a bankruptcy rate lower than the national average. The rest all had rates at least one third higher than the national average, showing that areas within a quick drive of a popular casino tend to have higher filing rates than the national average.

Most troubling for the Mid-South, however, is that of the six clusters, Tunica had the highest bankruptcy average. Additionally, the Tunica gambling cluster was home to the most counties with above average filing rates.

While this comparison does appear to show that areas within a quick drive of a popular casino tend to have higher filing rates than the national average, it does not take into account other variables.

One such variable is the overall economic climate of the area. State legislators often see casino gambling as a way out of government debt, so counties that are home to casinos or border casinos may have been more prone to high bankruptcy rates even before the introduction of gambling.

This was certainly the case for Tunica County, which was one of the poorest counties in the country before casino gambling was legalized in 1990. Tunica casinos raked in $1 billion dollars last year, and through the years has helped fund new schools and fueled local tourism. But the bankruptcy filing rate for its citizens is still one of the highest in the country.

So the line between bankruptcy and gambling is still dotted, if not indiscernible. But make no mistake, if you live in a casino county or adjacent to one the odds that you or someone you know will file for bankruptcy - is better than average.

After all – the facts are clear. In 2008 Shelby County reported a bankruptcy rate four times the national average; that’s 1 out of every 70 people. In 2009, it topped the charts with the highest filing rate in the U.S., according to statistics gathered by the National Bankruptcy Research Center.

But not all bankruptcies are equal and some argue the facts are misleading.

One argument – that Memphis is a victim of its own filing practices, and that perhaps it’s simply the type of bankruptcy Bluff City lawyers file that may inflate the numbers.

Another possible factor – gambling. The cotton fields that once lined the western border of Memphis are now dotted with casinos; the sixth highest grossing gaming destination in the U.S.

Is there a link between gambling and bankruptcy, and if so, how great is the impact on Memphis?

We’ll look at bankruptcy in Memphis, the degree to which gambling impacts that rate and how the Mid-South compares to other gaming areas.

Memphis: The “honorable” bankruptcy capital?

When we think of bankruptcy, we normally think of an individual or corporation walking away from all debt. But that’s not the case in Memphis.

According to the chief judge for the West Tennessee division of the U.S. Bankruptcy court, the Bluff City’s sky high filing rate isn’t what it seems. Memphians seeking bankruptcy are actually encouraged to pay back their debts, not write them off.

“The bar (lawyers) and judges in West Tennessee encourage debtors to file for Chapter 11 or 13 bankruptcy and work out a reorganization plan to repay debts, as opposed to other courts which may encourage filing for Chapter 7 bankruptcy, which discharges you from all excusable debts,” said Kennedy. This more commonly known type of bankruptcy, which discharges or erases debt completely, is only filed once.

But Chapters 11 and 13 bankruptcies typically filed in Memphis encourages debtors to develop a payment plan carried out over a number of years. If for some reason, however, the debtor is unable to make payments, like job loss or medical bills, the bankruptcy case can be dismissed before the debtor receives a discharge. This means the debtor must re-file to begin paying off debts again. So, one debtor could account for numerous filings.

Judge Kennedy says it’s this difference that makes Shelby County’s rate appear so much higher than the rest of the country.

The role of gambling

Another factor widely believed to affect Memphis’ bankruptcy rate is gambling. Less than an hour’s drive from downtown Memphis sits one of the top casino gambling venues in the U.S. – Tunica, Mississippi.

The parking lots of Tunica casinos are regularly filled with Shelby County license plates and speculation has always run high that Memphis’ bankruptcy problem stems from its proximity to the casinos.

But there is little data to prove a definitive causal link between gambling and bankruptcy. Dr. Jim Whalen, co-founder of the Gambling Clinic at the University of Memphis, says there is no evidence supporting the belief that gambling leads to bankruptcy. This doesn’t mean, however, that the two are not related.

In fact, gambling is believed to account for the dismissal of many bankruptcy cases. An article in the American Bankruptcy Journal reports that debtors who have many different credit cards, accrued debts that outpaced income, and have shown few attempts to repay creditors will often be dismissed from filing. These are behaviors commonly associated with problem gamblers. It is these types of cases that are often dropped because the debtor is believed to have acted in “bad faith,” behavior that is determined unsuitable for bankruptcy.

The dismissal of bankruptcy cases is one of the reasons researchers have a difficult time determining any link to gambling. If a debtor is judged to have acted in “bad faith” because of a gambling addiction, his petition is dismissed and there is no record of the bankruptcy.

Sometimes gamblers receive a discharge without their gambling debts ever coming to light. According to Kennedy, debtors are only required to list their creditors and not their individual debts. “If a person takes out cash advances on their credit card and loses all of their money at the casino, when they file their petition they only have to list the credit card and not the casino where they lost the money,” said Kennedy.

The only way to determine if gambling is involved is to examine credit card history to determine if individual transactions took place at casinos. This is a step not regularly taken by bankruptcy courts.

Whalen argues that many of these gamblers actually intend to act in “good faith,” but the addiction often gets in the way. “They are good family members, neighbors, and co-workers and they really believe that they will pay back debt,” said Whelan, “Unfortunately, they typically believe that the debts will be cleared as soon as a big win occurs.” And too often – that big win never comes.

The Proximity Factor

If bankruptcy rates and reasons for filing are cloudy, some would argue that Memphis’ proximity to Tunica is explanation enough for the high bankruptcy rate.

So we decided to examine the bankruptcy rate of areas close to popular casino gambling sites to look for similarities. We evaluated six different gaming clusters: Tunica (Mississippi), Detroit, St. Louis, Atlantic City (New Jersey), Foxwoods (Connecticut), and Niagara Falls. Each of these areas has at least two casinos within the metropolitan area. The clusters include the county that is home to casino gambling and each adjacent county.

These clusters were then analyzed for bankruptcy rates and where these rates ranked within each state, according to 2008 data from the Administrative Office of the U.S. Courts.

What we found is that all of these clusters had an average filing rate of 4.43 per 1,000 households or approximately 1 in every 225 people had filed for bankruptcy. That’s compared to the U.S. average of 3.53 or 1 out of every 284 people.

The comparison shows that only Connecticut had a bankruptcy rate lower than the national average. The rest all had rates at least one third higher than the national average, showing that areas within a quick drive of a popular casino tend to have higher filing rates than the national average.

Most troubling for the Mid-South, however, is that of the six clusters, Tunica had the highest bankruptcy average. Additionally, the Tunica gambling cluster was home to the most counties with above average filing rates.

While this comparison does appear to show that areas within a quick drive of a popular casino tend to have higher filing rates than the national average, it does not take into account other variables.

One such variable is the overall economic climate of the area. State legislators often see casino gambling as a way out of government debt, so counties that are home to casinos or border casinos may have been more prone to high bankruptcy rates even before the introduction of gambling.

This was certainly the case for Tunica County, which was one of the poorest counties in the country before casino gambling was legalized in 1990. Tunica casinos raked in $1 billion dollars last year, and through the years has helped fund new schools and fueled local tourism. But the bankruptcy filing rate for its citizens is still one of the highest in the country.

So the line between bankruptcy and gambling is still dotted, if not indiscernible. But make no mistake, if you live in a casino county or adjacent to one the odds that you or someone you know will file for bankruptcy - is better than average.